Covered calls are one of the most popular option strategies used by both short-term traders and long-term investors. In fact, The Snider Investment Method uses covered calls at its core to generate consistent cash flow. The strategy is more conservative than most option strategies and is relatively simple to execute—the key is understanding how to calculate covered call outcomes.

Let's review covered calls and look at how to calculate expected returns and possible outcomes before entering into a position.

What Are Covered Calls?

Covered calls are a two-part strategy where stock is purchased and calls are sold on a share-for-share basis. For example, you might purchase 100 shares of stock and simultaneously sell one call option. You receive a premium for the call option and you’re only required to sell the shares if the stock price is higher than the strike price.

Covered calls are a great strategy, but it’s important to understand all of the possible outcomes.

There are three popular reasons for using covered calls:

- Generating Income: You can generate a cash income by selling calls on a regular basis against an existing stock position. The Snider Method helps investors execute this strategy to fund their retirement income requirements. You can also reinvest the income to capitalize on the benefits of compounding over time.

- Exiting a Position: You can use covered calls to exit an existing stock position if you’re in no hurry to sell. If the stock rises to a price level that you’re comfortable with selling, you receive both the premium income and the capital gains—a win-win.

- Limiting Downside: You can use covered calls to help limit downside if you don’t want to sell a stock in your portfolio. If the stock price declines in value, the premium income offsets some of those losses with a cash income. If the stock recovers down the road, you still keep the premiums as extra income.

Covered calls are among the safest option strategies, but there are still two key risks to keep in mind:

- Opportunity Cost: You miss out on any appreciation in the underlying stock beyond the option’s strike price. If a company receives a buyout offer and the price soars, you are still committed to selling at the original strike price.

- Stock Decline: You are on the hook for losses if the underlying stock declines in value. While you have offset some of these losses with premium income, you still may be in the red on a net basis.

Covered calls are generally considered a neutral-to-bullish strategy, and they work best when you expect the underlying stock to maintain or slightly increase in value. If you are very bullish, you may want to simply hold the stock or purchase call options for more leverage. If you are very bearish, you may want to sell the stock or hedge with protective puts.

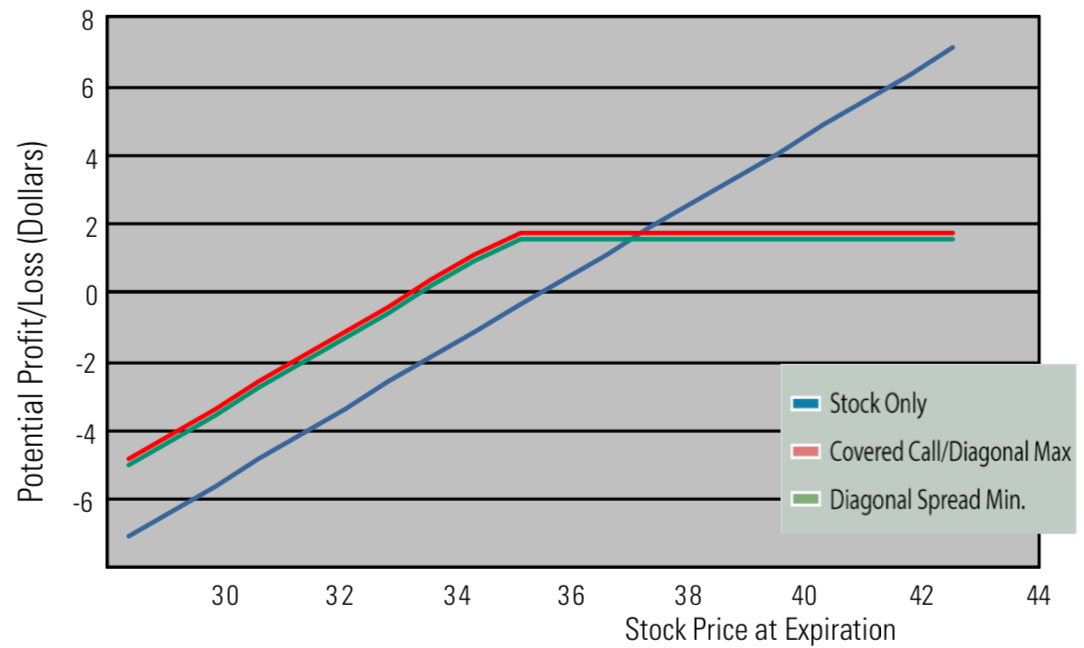

Visualizing Possible Outcomes

Option outcomes are often expressed in a profit-loss diagram that shows the max profit, max loss, and break-even point on a graph. The X-Axis represents the stock price at expiration and the Y-Axis represents the potential profit or loss. By looking at this diagram, you can visualize how the underlying stock price impacts the covered call’s profitability.

Let’s take a look at an example of a profit-loss diagram for a stock trading at $35.47 and a call option trading at $2.23 with a $35.00 strike price:

COVERED CALL PROFIT-LOSS DIAGRAM

Covered Call Profit-Loss Diagram – Source: CFRA

In the example above, the red line shows the covered call position and the blue line shows a long stock position for comparison. The covered call position levels off at the strike price of $35.00, reflecting the max profit potential. The covered call position also shows a break-even point of $33.24 where it crosses $0.00 on the potential profit-loss Y-Axis.

There are three key outcomes to calculate before entering into a covered call position: The max profit, the break-even point, and the max loss.

Max Profit

Covered calls have a profit ceiling since you’re agreeing to sell stock at a specified price. Even if the stock doubled in price, your upside would be limited by the strike price of the option and the premium that you received.

Max Profit = Call Premium + (Strike Price – Stock Price)

Break-even Point

The break-even point is the price at which you would break-even on the covered call position.

Break-even = Stock Price – Call Premium

Max Loss

Covered calls have a loss ceiling since you’re selling the right to something that you own. In the unlikely event that a stock price went to zero, you could lose the entire amount that you paid to establish the stock position, but still keep the premium.

Max Loss = Call Premium – Stock Price

Calculating Expected Returns

The most important calculation for many investors is the expected return of a covered call position. After all, if there’s a low expected return, it might not be worth the cost and effort to establish and manage a covered call. It’s also important to look at how expected returns are impacted when the underlying stock is called away.

Free download: Option Terms Every Investor Needs to Know

Static Return

The static, or unassigned, return is the covered call’s projected annualized net profit, assuming the stock price remains the same until expiration.

Static Return = (Call + Dividend) / Stock Price x (360 / Days to Expiration)

Assigned Return

The assigned, or if-called, return is the covered call’s projected annualized net profit, assuming the stock price rises above the strike price by expiration.

Assigned Return = (Call + Dividend) + (Strike – Stock Price) / Stock Price x (360 / Days to Expiration)

Expected Return

The overall expected return assigns probabilities to the static return and if-called return to come up with an overall expected return—although this calculation is more subjective.

Expected Return = (Probability of Being Called x Static Return) + (Probability of Not Being Called x If-Called Return)

The Bottom Line

Covered calls are a great way to generate cash income, sell out of positions, or limit downside, but it’s important to understand all of the potential outcomes. At a minimum, you should be familiar with the position’s max profit, max loss, break-even point, static return, and assigned return before making a trade.

What’s a strike price? Make sure you know these option trading terms

Covered call outcomes aren’t the only thing that investors must decide when using covered calls—they must also decide what stocks to purchase, what strike prices to use, what expiration dates work best, and many other factors.

The Snider Investment Method provides a complete framework for selecting stocks, choosing options, and managing covered call positions with the goal of generating a cash income. If you’re interested in a more hands-off approach, we also offer asset management services.