Options have become a popular way to speculate, hedge against risk, and even generate income. If you’re interested in trading options, you must apply for special permission from your brokerage. They will then assign an options level that they feel is appropriate based on your account, education, history, and other factors.

Let’s look at the prerequisites for different option trading levels and how to achieve the levels you want.

How Option Levels Work

Most brokers have three to five option trading levels, from beginner to advanced. For example, most novice traders and IRA accounts receive a level two authorization, enabling them to use covered calls and purchase call or put contracts. These basic levels require little more than a cash or IRA account with enough funding, along with basic options knowledge.

Level four and five authorization typically requires a margin account. These accounts enable you to borrow money from the broker to pay for a part of the trade. Since the broker risks losing money, these trading authorizations also require some options trading experience and sufficient funds or assets in the account to cover any losses.

The information that you need to provide generally includes:

- Investment Objectives: Brokers may ask if you’re targeting capital preservation, income, growth, or speculation. Investors looking to generate income may have better odds of approval than those looking to speculate.

- Trading Experience: Brokers may ask about the number of years you’ve been trading stocks or options, the number of trades you make per year, the average size of each trade, and information about your general knowledge of investing.

- Personal Financial Information: Brokers may ask about your liquid net worth, total net worth, annual income, and employment information to understand your financial health. Of course, those with more capital are more likely to get approval.

- Strategies: Brokers typically want an indication of the types of options you would like to trade. They may use this information to determine an approval level based on the strategies that you’d like to use in your account.

It’s essential to remember that these limitations are in place to protect you and the broker from losses. If you lie about your experience, you will have access to advanced options strategies where you can lose more than just your initial investment. There are countless examples of novice traders blowing up their accounts with options in a very short time.

Tips for Getting Approved

Request Option Trading Approval

The first step might be enabling option trading on your account. This could be done when opening the account or after it is already open. Many investors overlook this step when first opening their account because they don’t plan on trading options right away. Many brokers take a day or two in order to upgrade your account. They are also required to provide special disclosures including the Characteristics and Risks of Standardized Options.

Set Your Option Trading Level

Initially, most investors should be approved for level one strategies, enabling them to create covered calls. And, if you have a salary, some trading history, and a reasonably funded account, you should qualify for level two strategies, enabling you to buy put and call options. If you are denied these levels, you can usually reach out to your broker for approval.

Download Now: The Ultimate Guide to Writing Covered Calls. This e-Book has over 30 pages of content devoted to covered calls.

Many investors start with a level one or two approval and use covered calls, put options, and call options to get started. Although they may be looked at as “beginner” option strategies, these remain the most commonly used strategies by option traders of all skill levels. With experience utilizing these strategies, it is much easier to request higher levels of approval since the broker can see that you have options trading experience. At that point, the primary challenge is building up a margin account with sufficient capital.

If you’re applying for levels three through five without experience at the broker, the broker will look at the history and experience section on your application along with your salary and other disclosures. Also, keep in mind that you may need $25,000 or more in a margin account to use naked put or call options and different advanced strategies.

Becoming a Better Investor

The best way to move up to higher approval levels is to gain experience at lower approval levels. For example, novice traders should add covered calls to their repertoire before using iron condors or other advanced strategies. Keep in mind, more complexity isn’t always a good thing. These strategies often come with significantly more risk. Many traders never advance beyond the level of covered calls because they see their risk reducing and income generation capabilities as the best long-term approach.

The most basic options strategies include:

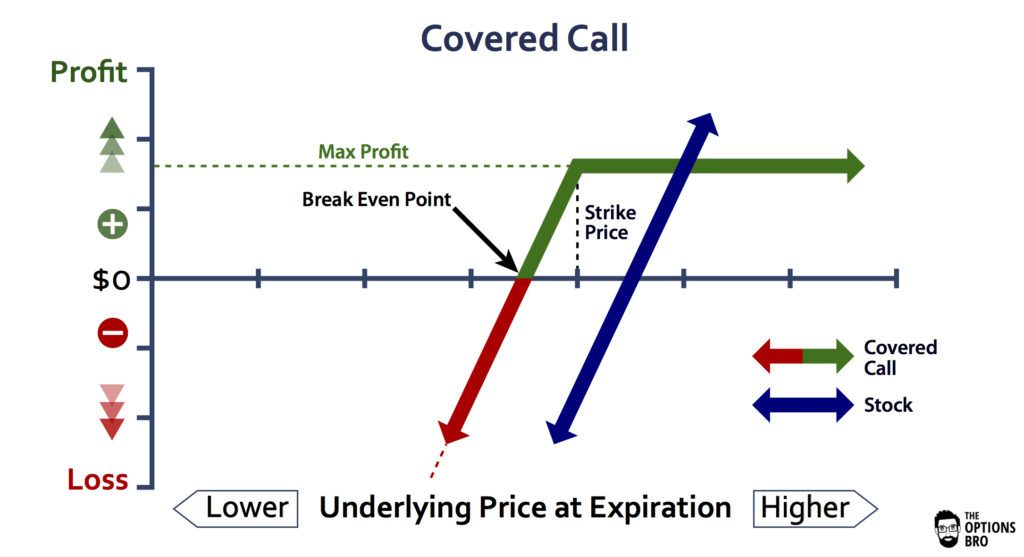

- Covered Calls: Covered calls involve writing a call option against a long stock position. If the stock doesn’t reach the strike price, you keep the premium payment as income. You can then write another call option to generate more income.

- Cash-Secured Puts: Cash-secured puts involve writing a put option with enough cash on hand to cover the position. If the put option isn’t exercised, you keep the premium income with a yield equal to the income over the cash collateral.

At Snider Advisors, we specialize in helping traders and investors use these two strategies to generate extra income in their portfolios. The Snider Investment Method helps answer some common questions that arise when using these strategies, including how to choose the right stocks, what strike prices to use, and how much to allocate.

The Bottom Line

Options trading has become increasingly popular for short-term speculation, hedging against risk, and generating income. Depending on the strategies you want to use, you must apply for an options approval level. The good news is that almost all investors have access to basic strategies, but some advanced methods require more capital and experience.

Don’t Forget to Download: The Ultimate Guide to Writing Covered Calls.

If you have basic options approval and want to generate more income from your portfolio, the Snider Investment Method can help you execute the covered call and cash-secured put trades.

Sign up for our free e-course or inquire about our asset management options.