More than a third of insured workers claimed social security benefits as soon as they became eligible in 2013, according to the Boston College Center for Retirement Research. The big question is whether this decision appropriately reflected the individuals’ circumstances or whether they made a costly mistake. If you’re approaching retirement, it’s important to carefully weigh the benefits and drawbacks of taking Social Security early.

How Does Social Security Work?

Most people that work pay taxes into Social Security, which is used to support those that currently receive benefits. As you work, you earn Social Security credits that are used to determine your future benefits. Most people require 40 credits – or ten years of work – to qualify for benefits, but there are exceptions for disabilities or survivor benefits. The benefits kick in at full retirement age, but it’s possible to receive benefits earlier at a cost.

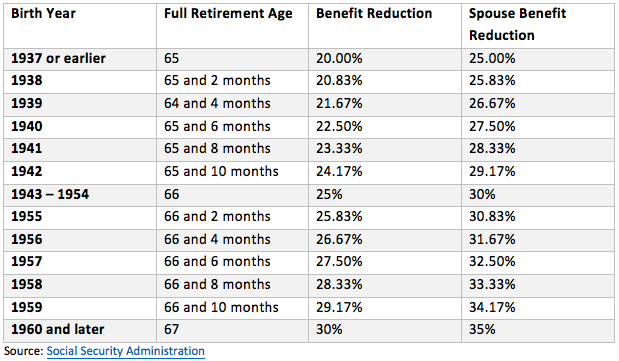

The Social Security Administration had set the full retirement age at 65 for many years, but beginning with those born in 1938, the age has been gradually increasing until it reaches 67 for those born in 1960 and later. You can determine your full retirement age using this table:

Benefits & Drawbacks of Early Benefits

Deciding when to take Social Security is one of the most important decisions you’ll make in your lifetime. In general, you will receive a higher monthly benefit if you wait longer and a reduced monthly benefit if you start anytime before retirement age.

You can start receiving Social Security benefits as early as age 62, but these benefits are permanently reduced by about one-half of one percent for each month you start receiving benefits before your retirement age. While that doesn’t sound like a lot, it can quickly add up over time – especially if you live a long full retirement. For example, if your full retirement age is 66 and two months, you would only get 74.2 percent of your full benefit at age 62. The table below shows the benefit reduction for you and your spouse if you take Social Security at age 62.

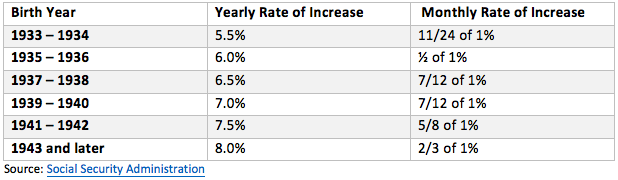

If you delay benefits, you will receive an incremental credit up to age 70. These credits vary from 5.5% to 8% depending on your birth year. You should always begin taking Social Security benefits at age 70, since the benefit increase no longer applies after that age even if you continue to delay taking benefits. The table below shows your monthly and yearly rate of benefit increase for delaying benefits until age 70.

You can see your actual projected benefits at age 62, full retirement age, and age 70 by requesting your Social Security Statement.

3 Factors to Consider

The decision to take Social Security early depends on a variety of different factors, such as health, finances, and employment.

Retirement Assets & Cash Needs

You should carefully consider your existing retirement assets and cash requirements when determining when to take Social Security. If you already have sufficient retirement savings, you may have more flexibility in taking early Social Security benefits. But if you need your full Social Security benefit to retire, you may want to consider postponing retirement until you reach full retirement age or later to ensure that you have enough money.

You can reduce cash needs by paying down or eliminating debt – such as mortgages or home equity lines of credit – during working years before retiring. While it’s tempting to assume that expenses will decrease during retirement, many financial planners find that clients tend to increase spending in retirement on things like travel. It’s important to develop a realistic idea of how much cash you will require to finance your retirement.

Life Expectancy & Breakeven Age

Your life expectancy plays an important role in deciding whether to take early Social Security benefits. The Social Security Administration’s Life Expectancy Calculator provides a basic idea of life expectancy, but you may also want to consider using more accurate calculators that take into account lifestyle factors. The Living to 100 calculator asks 40 questions related to your health and family history to come up with a more accurate estimate.

The breakeven-age can then be used to determine at what age the benefit of taking early Social Security is eclipsed by delaying Social Security. In particular, you should determine your full, delayed, and early benefits, figure out the take-home income in the months between and then determine how many months you would have to survive beyond the full retirement age to break even. The breakeven age for most people is typically around 77 or 78. For married couples, keep in mind the breakeven calculation should include more than just the individual’s age. Because of survivor benefits and a longer life expectancy between the couple, the calculation becomes a little more complex.

Free Download: Social Security Break-even Age Worksheet

If the breakeven age is above your life expectancy, you may want to consider taking Social Security early to realize the greatest financial benefit.

Spouse & Estate Planning

Your spouse’s age and health are important to consider when determining whether to take early Social Security. If you’re the higher earner, it often makes sense for you to delay your Social Security benefit. If you pass away, your spouse will then receive a much higher survivor benefit than they would otherwise receive.

Other Considerations

The Social Security Administration will let you pay back social security benefits that you’ve already received for up to a year if you decided to take early Social Security. You can then restart benefits at a later date and benefit from higher payouts. Since there is no interest or fees involved in the repayment, there is little downside to changing your mind and taking benefits at a later date apart from coming up with the money. Just keep in mind, this window ends 12 months after you initially file for benefits.

One other concern I often hear from clients is the long-term viability of the program and concern over considerable cuts to the program. While anything is possible, most of today’s retirees are unlikely to experience significant changes. Any changes in the program will likely impact future generations of filers, not those currently receiving benefits.

The Bottom Line

It’s generally a good idea to wait as long as possible before taking Social Security benefits since you can maximize your monthly income for the remainder of your lifetime. But, there are several different factors that could justify taking early Social Security. You should carefully consider these factors before making a decision since it can be extremely costly over the long run.