What is the

Snider Investment Method?

A long-term investment strategy designed to create income from your portfolio. It uses a combination of stocks, options, and cash in a specific sequence to maximize your portfolio’s income potential.

Goals of the Snider Investment Method:

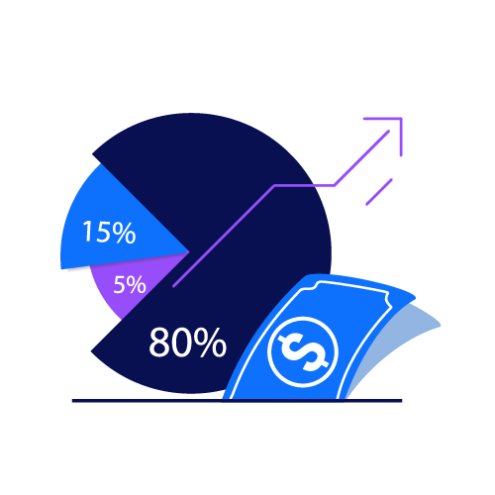

Our primary goal is to generate monthly income as close to 1% of our total investment as possible. We don’t select stocks because we think we know the future direction of their price, but rather to use them to generate income.

We buy fundamentally sound companies that we are willing to own for long periods of time, even if the price declines.

We define our portfolio performance by the Monthly Net Current Yield. Yield is all realized income – option premiums, gains on sold positions, interest and dividends, net of brokerage commissions, margin interested management fees. It does not include unrealized gains or losses

The yield calculation is different from the total return calculation typically shown by most in the investment industry. The yield is approximately equal to the total return if and when a position closes. While the position is open, there is typically some amount of unrealized loss. The total return measurement would include these losses and would be lower than the yield.

Key Components of the Snider Investment Method

Common investment concepts woven together in a unique way to achieve our investment objectives.

Selling Options for Income

In the Snider Investment Method, we only sell options. Covered calls and cash-secured puts generate option premiums boosting income from a stock portfolio. Whether the options are exercised or not, you get to keep the premium.

Stock Ownership

A strict stock screening process restricts our investments to financially healthy companies we are willing to own for long periods of time. With our focus on income, we buy stocks for their ability to generate income not hope they go up in price.

Cash Management

Dollar-cost averaging and laddering covered calls help create a consistent income in both up and down markets. Our risk management techniques help you create the reliable income needed in retirement

The Snider Investment Method is Perfect for You

You alone are accountable for your financial situation. No one cares more about your money than you do. That is why we believe investment education is essential for your success.

A Retiree ready to turn your hard-earned savings into a portfolio paycheck. Spend more without harming your portfolio.

A DIY Money Manager who enjoys trading and controlling your investments but needs the structure or plan to make you successful.

An Income Investor, familiar with cash flow investments, searching for a way to turn the stock market into a higher income-producing asset.